Suzlon Energy Closing Price: Loading...

Suzlon Energy is an Indian multinational company that specializes in wind energy solutions. It designs, manufactures, and installs wind turbines, offering end-to-end renewable energy services across the globe. The company plays a significant role in promoting sustainable energy by providing clean, affordable, and reliable wind power solutions.

Business Metrics

| Metrics | Value | Comment |

|---|---|---|

| Market Cap | 100630Cr | 14x of sales |

| PE | 109 | Very high - checking EPS growth (industry pe - 58) |

| Promotor Holding | 13.3% | Holding for last 3yr - low |

| OPM | 16.7% | Good |

| Interest Coverage | 7.29 | Comfortable |

| Sales | 7200Cr | |

| ROCE | 24% | |

| PAT | 862Cr |

Q1 FY’25 Concall Highlights

- Best quarter in 7 years

- Revenue increased by 50% YoY to ₹2,016 crores

- Consolidated EBITDA at ₹370 crores, up by 86%

- EBITDA margin of 18.4% on a consolidated basis

- PAT increased by 200% to ₹302 crores

- Strong balance sheet with net worth of ₹4,253 crores

- Net cash position of ₹1,197 crores as of June 2024

Order Book and Execution

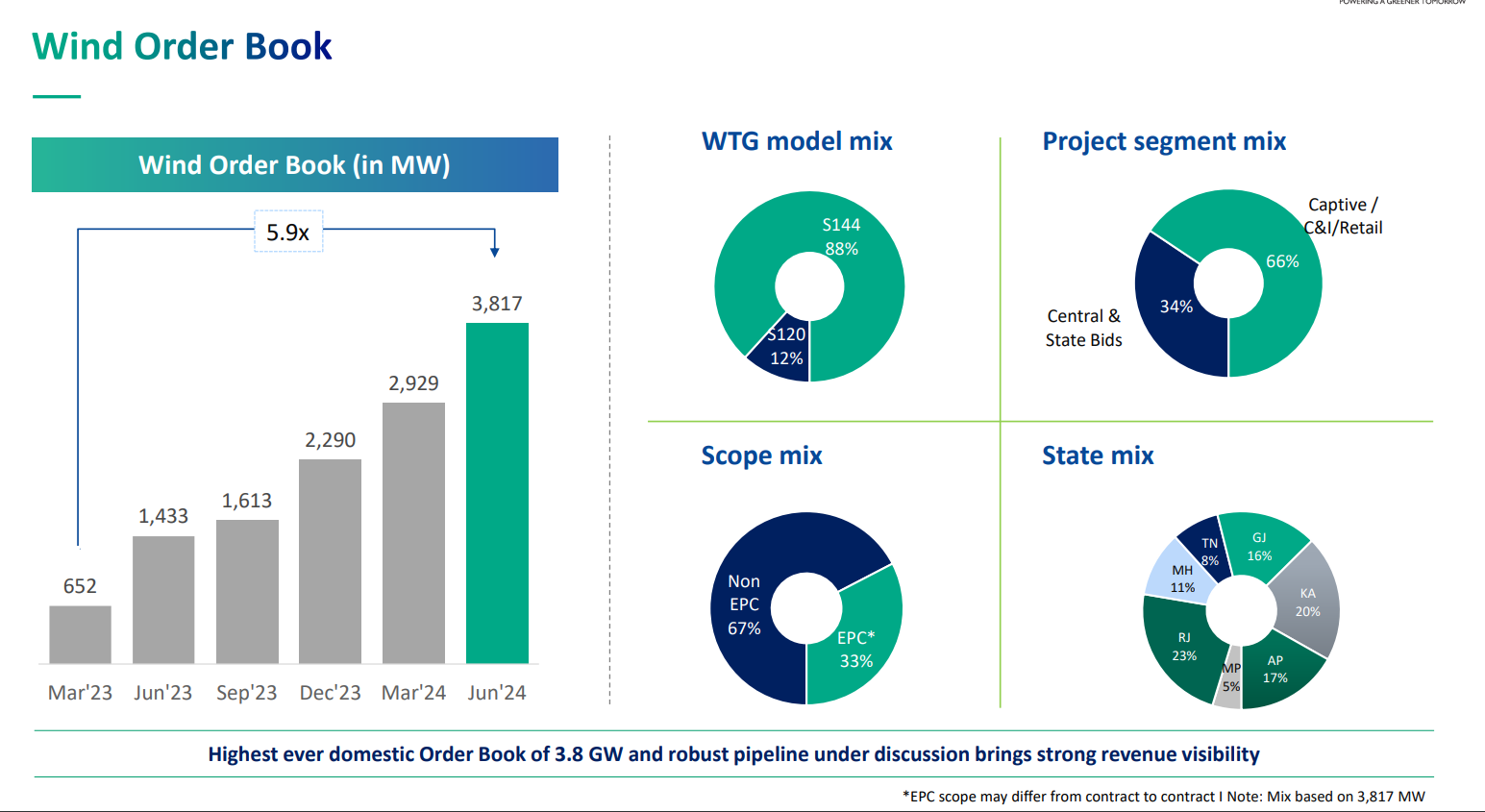

- Record order book of 3.8 GW as of June ‘24

- 274 MW delivered in Q1 FY’25, double the 135 MW in Q1 FY’24

- 70 MW commissioned in Q1 FY’25

- Focus on timely execution of the robust order book

- Selectively pursuing quality orders with higher value and better margins

Market Position and Industry Trends

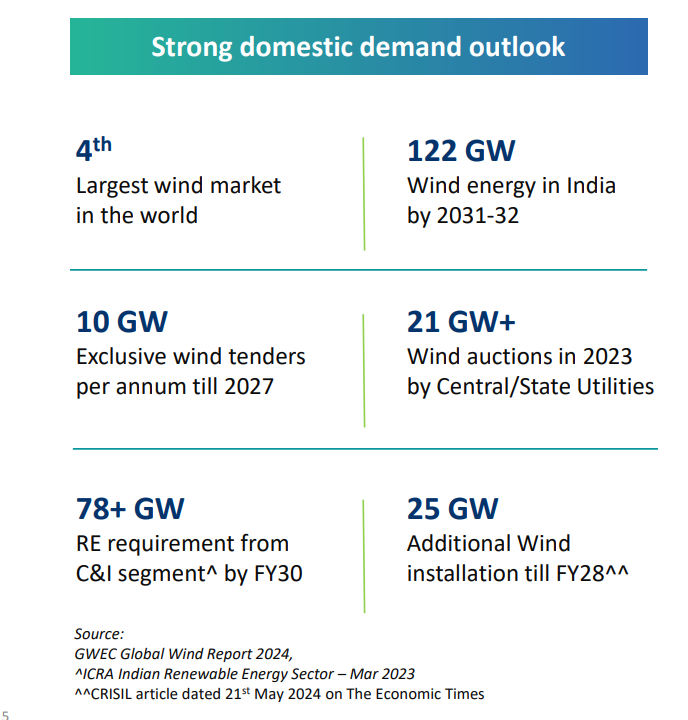

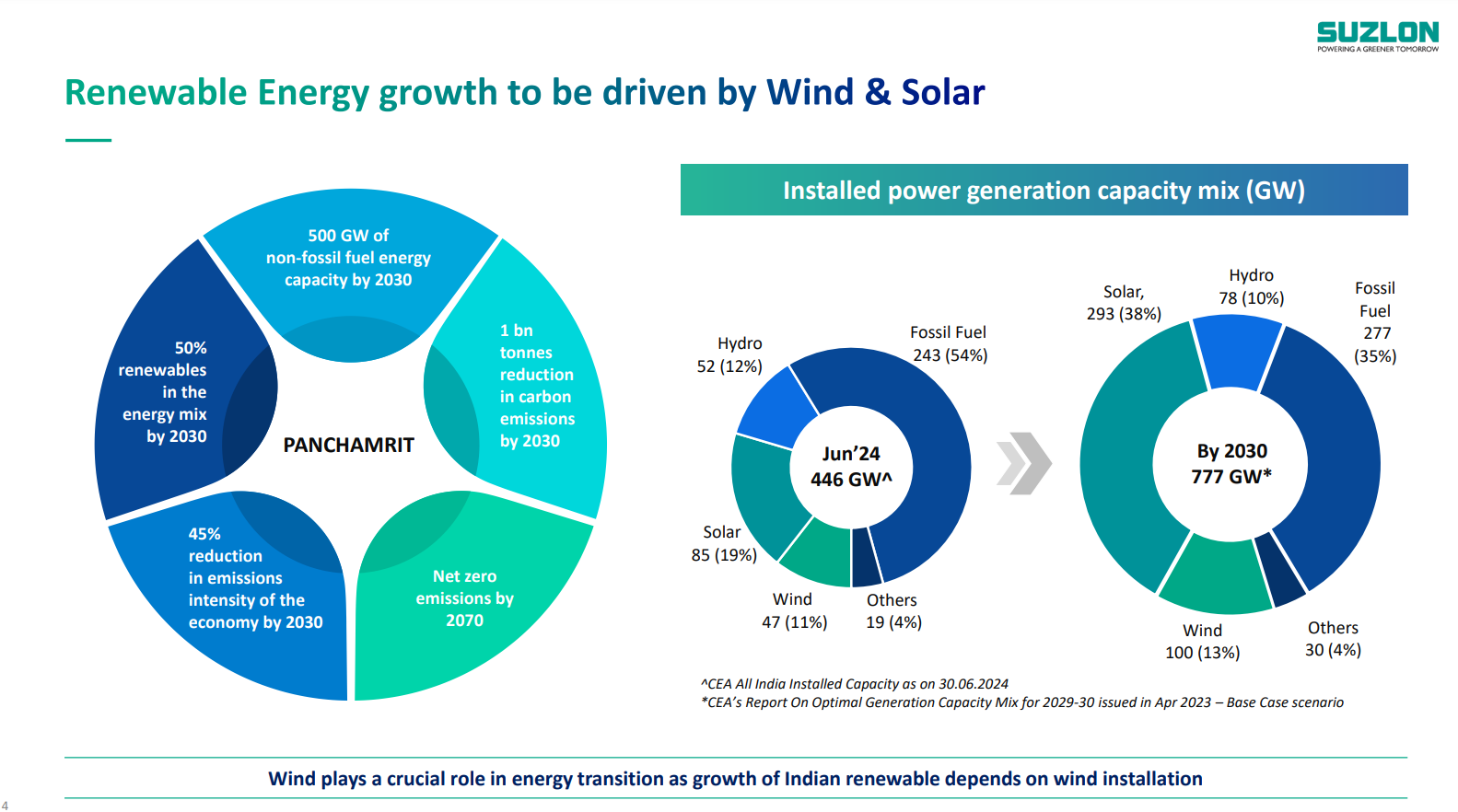

- India ranks 4th globally in total wind installations with 46 GW as of June 2024

- Suzlon’s S144 WTG model holds 32% market share in installed capacity

- Overall market share of 25-30% in India

- Indian wind sector expected to achieve 5 GW installation in FY’25

- Industry projections:

- FY’26: 6.5-7 GW

- FY’27: 8-9 GW

- Target of 100 GW wind capacity in India by 2030 (currently at 46 GW)

Operational Highlights

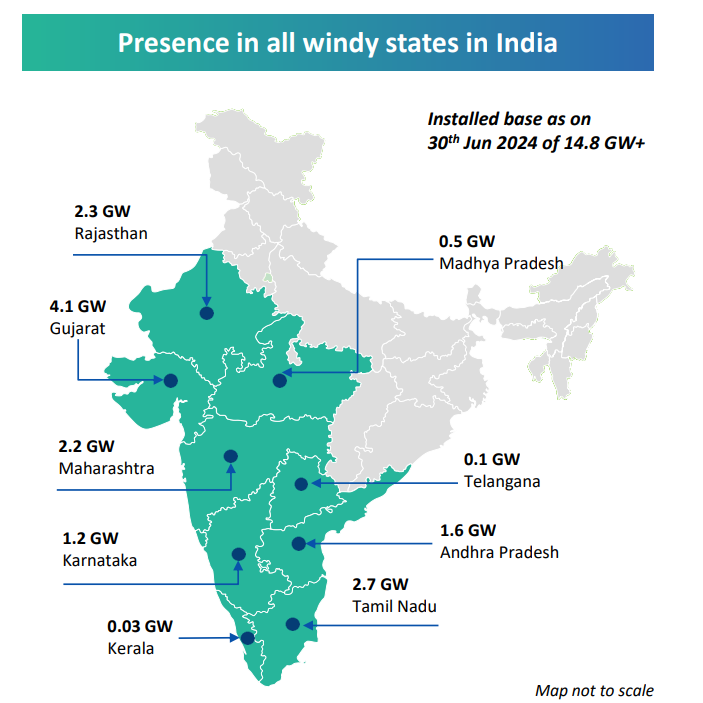

- OMS (Operations and Maintenance Services) business managing 14.8 GW with 96% availability

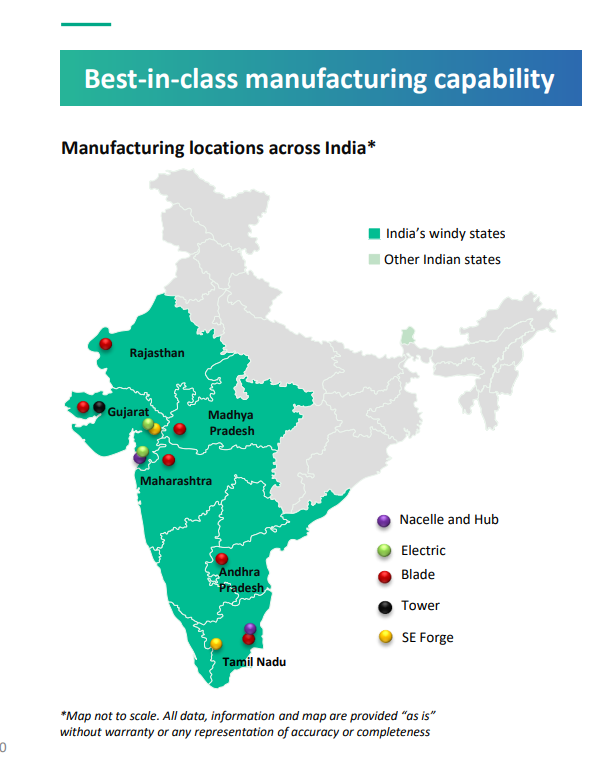

- Suzlon production capacity: 3.5-4 GW per year (assumed 60% utilization: 2-2.5 GW)

- Only company offering full EPC services, though only for 1/3 of projects

- Payment structure is milestone-based with separate contracts for supply, installation, and Balance of Plant (BoP)

Margins and Pricing

- Selling price: ₹5.5-6 Cr per MW

- Overall margin in mid to late teens

- Estimated margin per MW: ₹90 lakh - ₹1 Cr

- 8% EBIT margin expected to hold for next few quarters

Challenges and Future Outlook

- Main blockers: land acquisition and equipment transportation pathways

- Working on improving internal systems to minimize penalties and errors

- Implementing software and ERP tools for process automation

- Offshore projects in India facing viability gap of ₹7-8 Cr per MW

- Government announced viability gap funding for offshore projects

- No specific guidance on future order inflow or execution targets

- Expectation of stable or improving margins based on economies of scale

Miscellaneous

- O&M earnings typically start 2-3 years post commissioning

- IPPs (Independent Power Producers) now negotiate contracts post-winning bids

- Legal firm Khaitan found no non-compliances in audit report, made recommendations for improvements

- Total employees - 6400 - Great Place To Work certified

- 1900 Customers, 94 Sites, 9800 Turbines

Key Demand Drivers

- Onshore wind potential: 695 GW (120m HH) and 1,164 GW (150m HH)

- Wind bids with state specific sub-bids and pooling* of tariff

- RPO trajectory: 29.91% (FY24) to 43.33% (FY30) with wind-specific RPO

- ISTS charges waiver for 25 yrs. for RE projects COD till 30th June 2025**

- Lower Renewable LCOE resulting in strong C&I growth

- GH2 Mission targets 5 MMT p.a. requiring RE of 125 GW by 2030

- SECI’s auction for Green-Hydrogen and electrolyser manufacturing

- Repowering potential estimated by NIWE: ~25.4 GW

- Potential as export hub for wind components for global markets

- VGF scheme with INR ~7,500 crore outlay for 1 GW of offshore wind